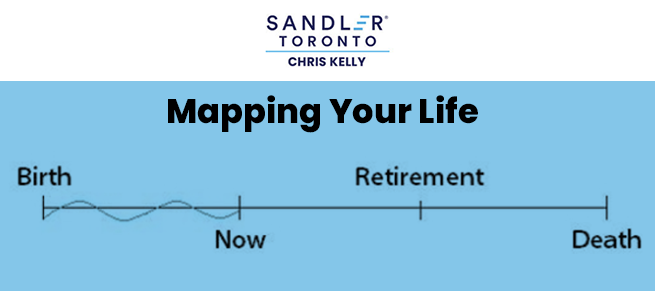

Try this exercise—it might feel uncomfortable, but it’s worth it.

Take a blank sheet of paper and draw a horizontal line. On the far left, write the year you were born. Easy enough, right?

Now, on the far right, write the year you think you might pass away. It’s a tough one—but it’s also one of the most powerful steps in planning your future.

Next, mark today’s date somewhere in the middle, along with the year you’d like to retire. Add key milestones—when you want to take that dream vacation, send your kids to college, buy a new home, or start something you’ve always wanted to do.

Now, draw a squiggly line from your birth to today—that time is gone, and you can’t get it back. The real question is: what will you do with the time that’s left?

Goal-setting requires honesty, reflection, and commitment. It’s not enough to think about your goals—you need to write them down and break them into actionable steps: yearly, quarterly, monthly, weekly, and even daily. Measure your progress and adjust as you go.

And don’t forget—your goals should cover more than just your career. True success includes balance: family, health, finances, spirituality, and personal growth all matter.

At Sandler Training in Toronto, we can help you map your future goals with clarity, purpose, and a plan that drives results—personally and professionally.